Our Head Investments, Felix Csajka, has written an article for the Private Banking Magazine which demonstrates the inadequacy of modern portfolio theory in wealth planning.

How can advisors bring more transparency to their clients’ long-term wealth planning? How can clients’ goals be achieved with a high degree of certainty? These questions usually remain unanswered in the advisory process for private clients. Goal-based investing / advice is on the rise. According to a recently published study by EY, many customers are looking for this type of financial advice.

In goal-based investing, the focus is on achieving customer-specific financial goals. This can be the purchase of real estate, an (additional) retirement pension during or early retirement. The question is how customers can best achieve their personal financial goals.

1. Starting Point

We are all concerned about our long-term financial goals and know at least the broad outline of our planned wealth contributions and assets. But we can hardly judge whether our goals are realistic and what is required to achieve them. How can we make our long-term wealth planning more transparent? How can we achieve our goals with the highest possible degree of certainty?

These questions should be at the heart of every advisory process, but they are seldom clearly answered for private clients. The appropriate methodology has been known for some time and institutional investors have been using it successfully for years. So why is it still not applied for individual wealth planning? The obstacle is, on the one hand, the technical implementation and, on the other, the traditional training of financial advisors. The focus is placed on the pure asset side as supported by the Modern Portfolio Theory (MPT). Long-term considerations on payouts and thus on the client’s goals remain excluded.

In the following sections, we present an example of how wealth planning should look like and why traditional approaches such as Modern Portfolio Theory fall short.

2. Why Traditional Methodologies Are Insufficient

The following example illustrates the different approaches in wealth planning and limitations of traditional methodologies:

Tom Siedler is 48 years old and taxable in Germany. He has medium- and long-term goals, namely to finance the education of his daughter at 2,000 euros per month over four years, and to secure his pension at 3,000 euros per month. His current assets amount to 300,000 euros in cash. He also owns a property worth 500,000 euros with a mortgage of 150,000 euros. His income secures his livelihood, but his assets do not grow. After retirement, he receives a monthly pension of 1,500 euros. Tom is currently uncertain whether he can achieve his financial goals. What possibilities does he have to achieve his goals in the best possible way?

We exclude solutions that are outside the realm of capital markets, such as: looking for a sponsor, saving, postponing expenses into the future or working longer, i.e. postponing retirement to a higher age.

a) Tom’s financial goals are not achievable with cash only

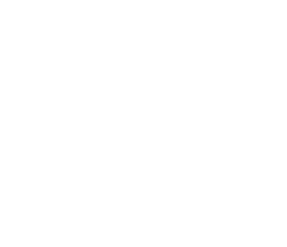

A long-term simulation over 1,000 capital market scenarios illustrates that Tom will not have enough liquidity during his retirement period to finance his pension goal (red triangle in Figure 1). The expected cash position is shown in blue, while the performance of the property is highlighted in yellow. The corridor is limited by scenarios with particularly poor (5th percentile of all scenarios) and good (75th percentile) market development; the plausible development is visible as a dashed line (median).

The simulation covers the period from today over the entire expected lifetime based on actuarial data. The achievement of Tom’s financial goals can be seen in the chart below: his daughter’s education between 2020 and 2024 is guaranteed, but a cash account cannot guarantee his pension. Of course, we also include other components such as contributions, loans or asset goals in the simulation. Moreover, Tom can further improve his situation by mortgaging his property, which is not illustrated in this example. Finally, as a taxpayer, he has to pay tax on his income and capital gains, and he has to consider the long-term impact of asset management costs.

Tom’s wealth development and goal achievement likelihood (blue corridor: development of liquid assets, directly affected by financial goals. Orange corridor: real estate. Red triangle: liquid assets completely depleted in the median scenario).

This simulation shows that Tom will face difficulties during his retirement. Therefore, the crucial question is: What can he do to fully achieve his personal financial goals?

b) Improving the achievement of Tom’s goals by means of Modern Portfolio Theory

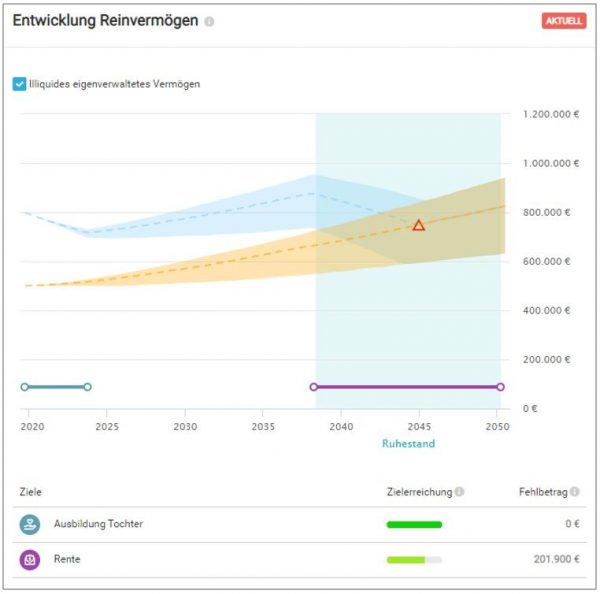

The best-known approach for an optimal investment strategy is Modern Portfolio Theory (MPT): in MPT, investments are optimised according to their risk-weighted returns. This approach was originally developed by Harry M. Markowitz, who was awarded the Nobel Prize for Economics in 1990 for his work in the field of portfolio selection. Markowitz had already laid the foundation in the 1950s, which William Sharpe further developed into Modern Portfolio Theory. Therefore, Modern Portfolio Theory is based on a foundation that is more than 60 years old. The basic idea is simple: we only look at expected return and risk and select the portfolio with the highest return for a fixed risk, or the portfolio with the lowest risk for a fixed expected return.

Thus Tom can try to optimise his portfolio based on MPT. In practice, this implies an estimate of the expected return for each asset class over a period of time, such as the next month or quarter. The result of the optimisation is a set of allocations that differ in risk and expected return. Tom then has to choose which allocation matches his risk profile.

Efficient Frontier according to Modern Portfolio Theory: portfolios with minimal risk at a given expected return.

The result of the MPT optimisation is based on assumptions which are very unstable: Firstly, expected returns are never “spot landings”, but are often far off in practice, as every investor has knows only to well. Secondly, volatility (the standard deviation of returns) is used as a risk measure, which is underestimates drawdowns, especially in crises.

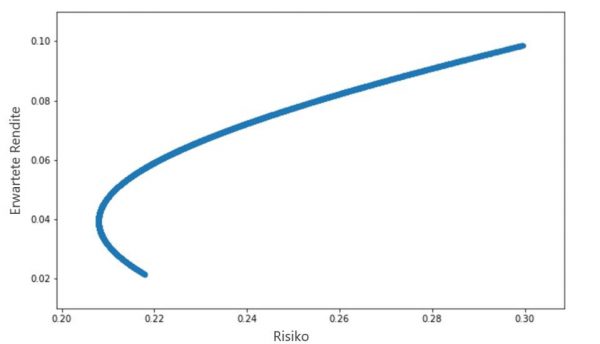

Further, the MPT is based on a normal distribution of capital market returns: Fluctuations are modelled as normally distributed, and the mean corresponds to the expected return. Practical experience shows that a normal distribution simplifies financial markets too much. The reality looks quite different:

Example of non-normally distributed returns: Quarterly return on emerging market equities (1,000 scenarios, 400 quarters)

Furthermore, the MPT Optimisation does not tell Tom if he can actually achieve his financial goals or not: the MPT Optimisation only considers the assets but ignores Tom’s personal balance sheet which includes also liabilities, namely credits and goals. In addition, the optimisation is not robust because small changes in expectations may significantly change the proposed allocation. Finally, the analysis is limited to a single investment period. In financial and wealth planning, however, goals may lie either in the near or distant future and normally have different time horizons. Thus, the consideration of a single investment period is misleading.

3. The Solution: Goal And Scenario-Based Optimisation

Capital markets must be modelled realistically, even for strong market correction. This is contrary to the conventional model of a normally distributed market. In addition to the financial goals, the holistic view should also include illiquid investments such as real estate, which can contribute to achieving the goals. In contrast, liabilities and outstanding loans reduce the goal achievement. Finally, inflation and interest rate scenarios must be taken into account in jointly with capital market returns, as they have an impact on assets, liabilities and goals.

Multiperiodic simulation and optimisation reflect the long-term situation of the client. The time value of the goals is automatically taken into account, i.e. financial goals in the distant future have a lower present value with positive interest rates than goals in the immediate future. The objective function of the optimisation measures the deficit (underfunding) of the financial goals and gives the client a clear and quick insight into his financial health and wealth planning.

a) The Basis: Scenarios for Capital Markets

The optimisation considers a whole set of possible capital market scenarios. This also applies to liabilities such as mortgages, which also depend on scenarios via the development of interest rates and inflation. The capital market scenarios contain common asset classes such as money market, equities, bonds of different credit quality, real estate and commodities. They also include interest rate and inflation scenarios to model inflation-linked spending and loans. Scenarios avoid the estimation error of a single value for the expected return, a significant problem in practice. This makes scenario-based optimisation more robust than the classic method of MPT optimisation. Economic realities such as the currently occurring negative interest rate are also explicitly taken into account and not averaged out.

The scenarios are calculated for each asset class. The calculation is based on economic models for interest rates, economic growth and inflation. The implementation is carried out with investment products such as individual securities, ETFs or funds, which represent the allocation either actively or passively, depending on client preference.

b) How does goal and scenario-based optimisation work?

Goal and scenario-based optimisation has similarities with the calculation of dynamic processes known from the natural sciences. For example, path integrals consisting of a set of possible paths are known in physics. We can apply similar stochastic methods for goal-based optimisation. The objective of the stochastic optimisation is to achieve the lowest possible average error, measured as a deviation from the complete achievement of the goal across all scenarios.

The optimiser finds the best solution step by step by changing the allocation: changes with a better goal fulfilment are preferred, and the optimiser learns allocations with a better goal fulfilment. A key difference to MPT is the multiperiodic nature of the optimisation: it no longer covers just a single period, but the entire lifetime, with all important aspects, included as already discussed. Payouts at different times are explicitly taken into account, which is not the case with MPT.

c) Tom’s financial planning using multi-periodic, goal- and scenario-based optimisation

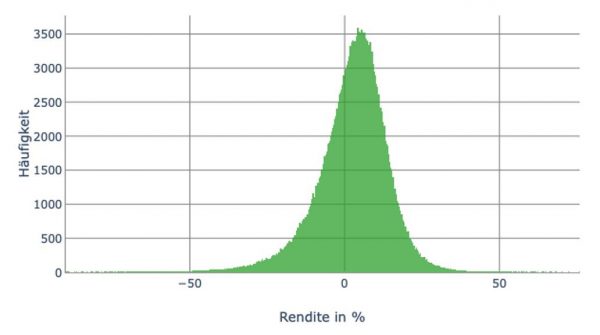

Tom’s wealth planning becomes clear based on this optimisation: he now knows which allocation offers the highest goal-achievement probability. He also has a realistic view of the risks and knows which goals he is most likely to achieve.The optimal allocation for Tom’s specific asset situation and objectives consists of:

37 percent equities

- Equities Germany: 17 per cent

- Equities Emerging markets (in local currency): 20 per cent

63 percent bonds

- Government bonds (investment grade, in Euro): 12 per cent

- Mixed Bonds (investment grade, in local currency): 10 per cent

- Corporate bonds (investment grade, in Euro): 30 per cent

- Global bonds (high yield, in Euro): 11 per cent

Money market investments are no longer included in the optimised allocation because Tom is better off with a riskier portfolio due to the long-term investment horizon than with the modest return expectations of the money market.

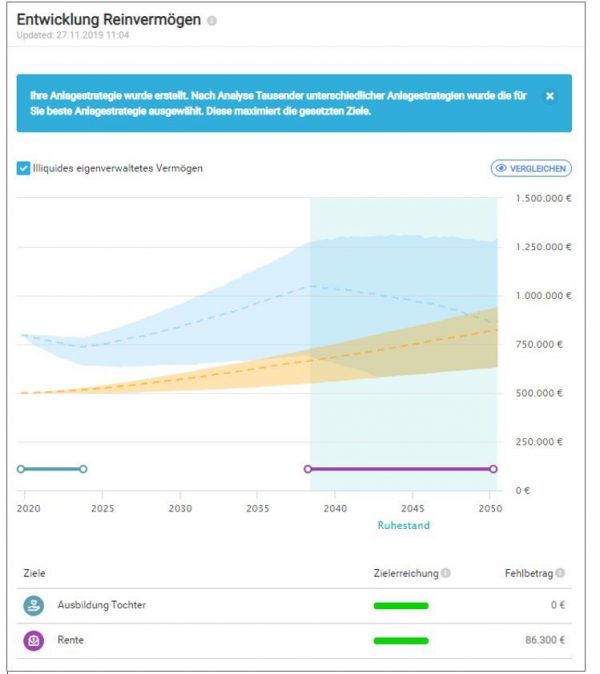

Tom’s optimised goal achievement and wealth development

The likelihood to achieve the second, more demanding goal (to secure the pension of 3,000 euros per month), increases significantly, while the goal achievement of the first goal remains unchanged. Additionally, Tom’s planning becomes more flexible: he can adjust his goals, add new goals and obtain a detailed picture of his financial future. This also includes the simulation of life events such as inheritance, divorce and much more, which can change the financial situation significantly.

4. Conclusion

Integrated financial and wealth planning requires realistic methods that take the individual goals of the client into account. Goal- and scenario-based optimisation meets these requirements: The capital markets are modelled realistically for many scenarios, and stochastic optimisation finds the allocation which fulfils financial goals in the best possible way. It includes the personal situation of the client in all aspects and is not limited to liquid assets.

Modern Portfolio Theory is not adequate as an approach for wealth planning and goal-based investing: Goals are not optimised, the estimation error of the optimisation variables distorts the result, and observations over different time horizons are not possible. Modern Portfolio Theory is not a holistic asset allocation approach including liabilities, but a one-period approach: It is valid for a single (typically short) time period and considers only the asset side, not the whole balance sheet of the client.

It is time to rethink wealth planning! Short- and long-term financial goals require a goal- and scenario-based optimisation that is directly tailored to the client – instead of the outdated Modern Portfolio Theory.