Financial planning is highly valued by clients. However, usually, only wealthy clients receive a financial plan, while their willingness to pay is limited. Furthermore, clients often look in vain for seamless advice that combines “financial planning” and “investment advice”. This article shows the possible solutions.

What clients want

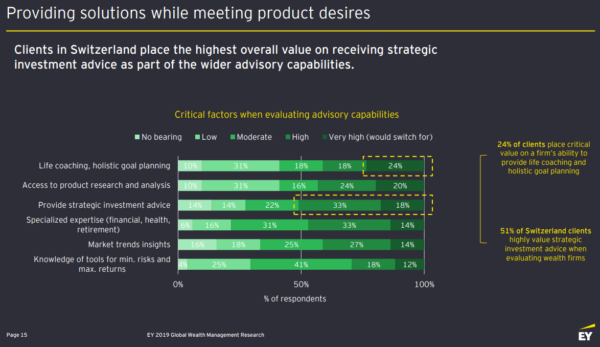

Clients have financial goals, even if they sometimes have difficulty formulating them. This picture changes in most cases once you ask them about their wishes or dreams instead of their financial goals. While our wishes or dreams act as a meaningful inner drive, the financial means for achieving them are – as the name suggests – only a “means to an end”. Negative emotions also play an important role in this respect. For example, the Worry Barometer 2019 of Credit Suisse and gfs.berne puts retirement provision in first place. For this reason, it is not surprising that, according to a study published by EY at the end of 2019, 42% of all clients surveyed in Switzerland are interested (18%) or very interested (24%) in “life coaching & holistic goal planning”, while 51% also want strategic investment advice.

Figure 1: What clients in Switzerland want in terms of advisory skills

What banks offer today

Only a few clients of private banks in Switzerland receive financial planning as part of their investment advice – in contrast to the Anglo-Saxon region, where so-called goal-based investing or goal-based planning is increasingly becoming the norm and serves as the basis for investment advice. Banks in Switzerland usually offer the following service levels as part of their advisory mandates:

- Advice without portfolio view: transaction-related advice (“investment recommendations”)

- Portfolio-based advice: Usually based exclusively on the asset components booked with the bank. Often, this type of advice is further differentiated in terms of portfolio monitoring and proactivity of the advisor.

What all service levels have in common is, that in most cases, clients do not receive a holistic overview of their assets, nor are their goals and wishes considered. Almost always, a standardised investment strategy is assigned based on a risk profile (e.g. “Balanced”), which does not take any goals or wishes into account. This investment strategy is then filled with investment products, whereby recommendation lists and research are regarded as central.

Financial planning is offered by specialised teams, but often only on demand. Commonly, the focus is on tax optimisation. Moreover, the methodologies and advisory solutions used for this purpose rarely correspond to the approaches used in investment advisory. As a result, clients are often confronted with a dual offer instead of receiving seamless, consistent advice.

Possible solutions

Therefore, the following discrepancies exist:

- Clients want “life coaching & holistic goal planning” and “strategic investment advice”, but banks hardly offer these services

- On request, banks offer financial planning services separately, but they tend to focus on tax advice and rarely meet the desired strategic investment advice.

This conflict of objectives can be resolved as follows: Banks offer goal-based investing as a basic service, while financial planning with a focus on tax optimisation is a higher-value service that is priced separately (“upselling”). That way, the central client needs are met and the willingness to pay for financial planning increases.

What does this mean for the revenue components? How can investment advice and financial planning be charged to clients? There are various positive starting points for financial service providers in this respect:

1. A higher value of portfolio-based advice

Portfolio-based advice will continue to be priced structurally as before, but slightly higher prices can be charged as the range of services on offer, including goal-based investment, is of higher quality.

2. Upselling into specific financial planning services

Most clients will have met their primary needs with a goal-based investing approach. This makes upselling into specific financial planning services such as tax optimisation, pension/asset planning or succession planning for entrepreneurs easier to justify and implement. As before, the price structure remains the same as before.

3. Positive influence on new money

Goal-based investing only makes sense if a holistic view of the total wealth is taken to calculate the client-specific achievement of objectives – after all, non-bankable assets can also be used to increase while loans might reduce or increase goal achievement. It is important that the client experience is interactive and that clients are motivated to disclose all assets. This can be achieved if every input instantly calculates goal achievement. As such, the advisor can position himself as a “trusted advisor” and advise the client in the overall wealth context. This simplifies the acquisition of new money since there is clarity about the total wealth of the client.

4. Cross- and Upselling

The same applies to cross-selling as to new money: if an advisor knows when a loan is due or when a life event such as a house purchase is imminent, this allows actively managed sales activities, e.g. a loan renewal, an insurance sale, retirement or an estate planning.

In essence, financial planning transforms with goal-based investing in the direction of tax optimisation, retirement planning, estate planning or succession planning for entrepreneurs.

How 3rd-eyes analytics can support you

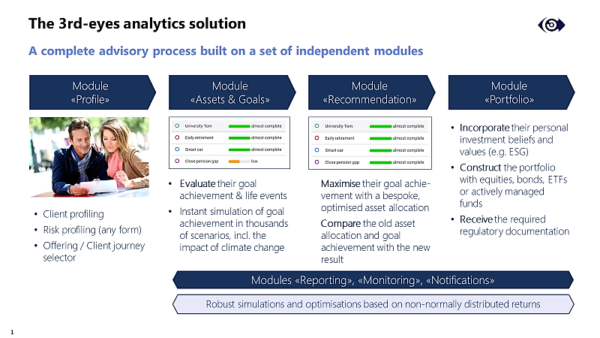

Today, client advisors of banks usually do not have solutions that allow them to easily create forward-looking simulations in the sense of goal-based financial planning. 3rd-eyes analytics offers the adequate solution – either as a supplement to existing advisory solutions or as a full replacement of those.

Figure 2: Entire advisory process of 3rd-eyes analytics

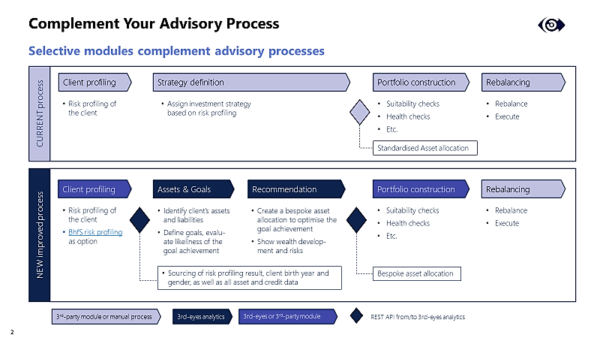

As an alternative to using the entire advisory solution from 3rd-eyes analytics, the existing advisory process is supplemented by the following modules with modern interface architecture (Figure 3).

Figure 3: Extension of the existing advisory process

Module «Assets and Goals»:

First, the overall wealth of the clients, including their goals, is evaluated and the achievement of goals is calculated in thousands of capital market scenarios. All bankable assets, including those with third parties, are considered. This also applies to non-bankable assets as well as inflows, outflows and loans.

Module «Recommendation»

The goal achievement is maximised by seeking the best possible strategic asset allocation (SAA) for each client individually. Unlike the three or five standard SAAs that are normally offered by wealth managers, the basis for this can be either 5, 10, 100 or millions of different SAAs – depending on the bank’s preference. These are each combined with thousands of capital market scenarios. Their goal achievement is then compared to ultimately select the SAA with the highest goal achievement (whereby the optimization function can be parameterized).