IRIS: Instant. Realistic. Individual. Sustainable.

We provide analytical software solutions that empower financial institutions to

Our clients benefit from out team’s vast experience in sustainable finance, asset management, Asset Liability Management, and last but not least wealth management transformation.

Discover some of our use cases

Our Capabilities

Available as individual APIs or as Software-as-a-Service solutions

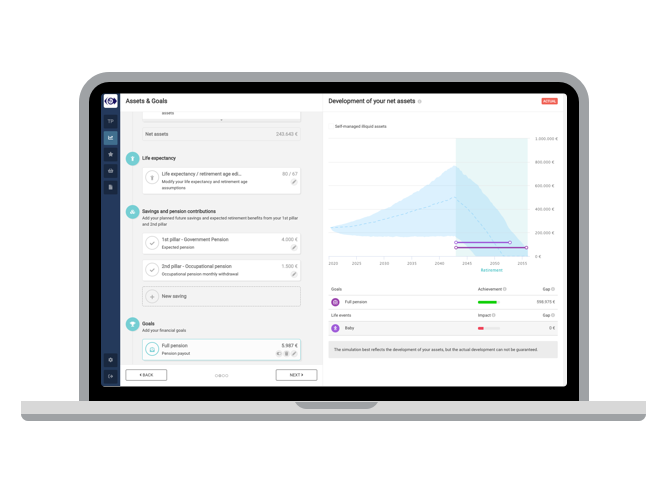

360° Time Machine

Realistic wealth and goal achievement simulations considering all factors influencing clients’ wealth and goals in thousands of market scenarios

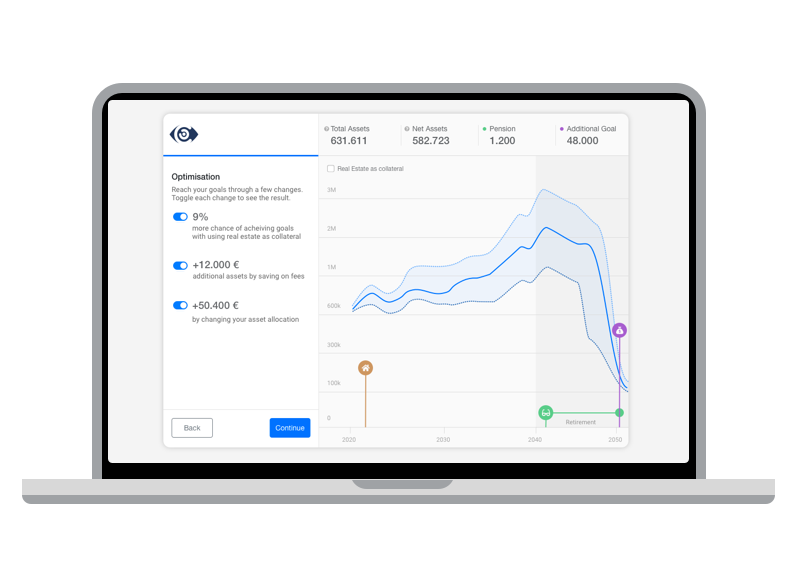

Optimisation

Various optimisation functions to

optimise the strategic asset allocation

(multi-goal ALM optimisation,

(multi-goal ALM optimisation,

Sharpe Ratio, etc.)

Portfolio Construction

Portfolio construction available based on client’s preferences