Summary

This paper discusses the evolutionary pressure on financial services companies and their strategic advantage of being able to integrate modern software architecture into a legacy environment. It illustrates three different approaches to software architecture and discusses the best approach to leverage modern architecture to stay globally competitive. Finally, it shows different depths of integration on the example of the 3rd-eyes analytics application.

1. Introduction

Financial institutions compete in an environment of increased evolutionary pressure with changing business models, increasing regulatory requirements and constant technological innovation.

To compete in this world, companies need to be:

Globally Competitive: In a “flat world” (as described in Thomas L. Friedman’s 2005 book) every company is competing in a globally level playing field. The standards and expectations are the same whether you are in Iceland or in Kenia. Being the regional champion is no longer sufficient.

Collaborative: Companies must be able to harness the required know-how all over the world and build collaboration networks to develop world-class solutions. No single institution has the depth and breadth of knowledge internally to compete on a global level on all fronts.

Nimble: As COVID 19 reminded us again, the world can change in the blink of an eye. Survivors are those light on their feet and able to adapt quickly to the evolutionary pressure.

2. Competitive Readiness

To assess the competitive readiness of a financial institution, we have to take a closer look at its IT infrastructure. This is where the business processes are condensed – or in some cases crystalized – into the functional backbone of a company. The infrastructure can be categorized by its architectural style. There are three distinct styles that we describe as Incrementalism, Radicalism and Structuralism.

Incrementalism is what most of us did in the past: we added more of the same, re-used what we already had. Maybe over the years, there were subtle changes in technology.

This architectural style is characterized by a plethora of technologies, unmanageable complexity and high maintenance cost.

Radicalism is the place where most start-ups are because they started on a green field and didn’t have to care about any legacy.

This architecture is characterized by:

Modularity: The applications are split into clearly defined and segregated modules or components.

Loose coupling: The Components behave like individual microservices that can connect with each other and with Core Applications.

Open Standards: The loosely coupled components communicate over Open Standards.

Structuralism is a hybrid form between Incrementalism and Radicalism. It preserves what is still needed (the superstructure) while replacing the “plumbing” and adding new features.

Structuralism is a transitory architecture. Its sole purpose is to buy time to phase out the old superstructure while enabling new business.

Structuralism is following by the same architectural principles (modularity, loose coupling, open standards) as Radicalism but employs it on legacy infrastructure.

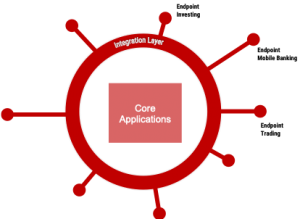

This is achieved by means of an Integration Layer (the “plumbing” in the analogy above). An Integration Layer encapsulates Core Applications with a layer that is supporting modern API standards, such as REST.

Integration Layers often include persistent storage to enable easier access to data that has to be assembled for/from several Core Applications.

The Integration Layer is a segregation between old and new.

3. The Strategic Advantage of Structuralism

For an established financial services company, Radicalism is rarely feasible. Very few companies will have the risk appetite and the resources to build something completely new on a green field.

Incrementalism is what most companies do anyway. But there is a point, where investing into old technology and heaping up legacy just does not make sense anymore. This point approaches fast, when complexity and cost (run-the-bank) are so high that there is little room left to maneuver.

In that case, Structuralism is the only way out. The first step on this road is the installation of an Integration Layer. This is by no means an easy endeavor, but it has immense strategic advantages:

- It buys time by encapsulating critical components (such as transactional infrastructure and large-scale databases) to be replaced at a later point in time

- It enables the implementation of modern technologies and services

- It is cost-effective

- It is a manageable risk

Once the Integration Layer is in place, state-of-the-art applications (such as 3rd-eyes analytics) can be deployed, enabling the company to compete on the global playing field again.

4. Example: The 3rd-eyes analytics Application

3rd-eyes analytics puts great emphasis on enabling the seamless integration of our application into any environment. The architecture is modular, loosely coupled and based on open standards. It provides all the necessary components to integrate a holistic, goal-based investing solution into any environment of a financial institution.

Our architecture consists of 7 loosely coupled modules, communicating over open standards (REST):

The Simulator is an interactive calculation engine that simulates the evolution of wealth and the achievement of goals in a scenario space

containing up to 5’000 capital market scenarios.

The Optimizer is a calculation engine that finds the optimal asset allocation by maximizing goal achievement. It is also coupled to a scenario space.

The CRM/Profiler contains the personal client data and the risk profiles required by the regulator.

The UI provides a fully customizable User Interface that improves the usability for the client.

The Portfolio Construction Module allows the construction of portfolios based on the optimal asset allocation, personal values of the client and his/her preferences.

The Report Generator documents the whole advisory process.

The Monitoring Module alerts the client or advisor by email when goals are due or re-balancing of the portfolio is required.

The APIs are fully configured to the customer needs.

5. Depths of Integration

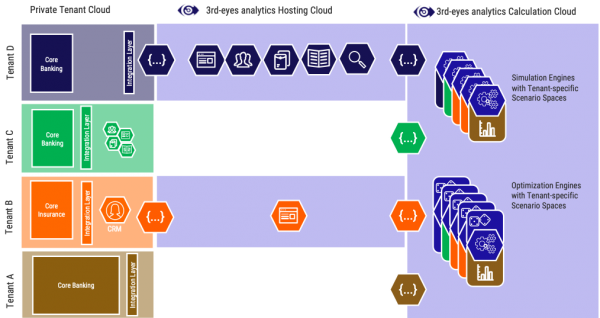

As the Figure below shows, the 3rd-eyes analytics components can be deployed at different depths of integration and in private, public or hybrid clouds. They are delivered in the form of Docker containers and can easily be integrated in any environment.

The only exceptions are the Simulator and the Optimizer, which are bound to the 3rd-eyes analytics Calculation Cloud to harness the elasticity and scalability of the cloud infrastructure.